Buffalo NAS Wiederherstellung in der Praxis

TESTSIEGER DATENRETTUNG

Denn Datenrettung ist Vertrauenssache!

TESTSIEGER DATENRETTUNG (Erfahrungen unserer Kunden)

Denn Datenrettung ist Vertrauenssache!

Buffalo NAS wiederherstellen im Reinraum-Labor

Was bieten Buffalo NAS Geräte?

Buffalo Technology ist ein international operierender NAS Hersteller von Netzwerkfestplatten, Speicher- und Multimedialösungen. Im Bereich der Consumer-NAS (Network Attached Storage) gehört Buffalo zu den globalen Marktführern.

Das Unternehmen hat sich mit seinen NAS-Speicherlösungen insbesondere auf den privaten Einsatz sowie auf kleinere und mittlere Unternehmen spezialisiert: So wurden beispielsweise die Buffalo Tera Station Netzwerkspeicher gezielt für die Bedürfnisse kleiner und mittelständischer Unternehmen entwickelt, die eine performante Lösung zur Speicherung Ihrer NAS Daten benötigen. TeraStation NAS Systeme weisen 4-8 Festplatten-Einschübe (HDD Bays) auf und bieten so ausreichend Speicherkapazität für den Unternehmenseinsatz.

Speziell für den privaten Einsatz hat das Unternehmen Buffalo Technology zudem die Buffalo Multimedia NAS Netzwerkspeicher der LinkStation-Serie auf den Markt gebracht (Buffalo Link Station Live, Buffalo LinkStation Mini). LinkStation NAS Systeme verfügen über 1-4 Bays und können so bis zu 4 Festplatten aufnehmen. So bieten sie ausreichend Kapazität zur Speicherung von NAS Daten, seien es Backups von Computern oder der Multimedia-Sammlung.

Die meisten NAS Boxen von Buffalo verwenden das SGI XFS-Dateisystem, welches als sicher und überaus performant angesehen werden kann. Bei kleineren NAS Geräten kommt bei Buffalo meist ein RAID-0 (Striping) zum Einsatz und ab Werk werden die Geräte mit Festplatten von Seagate ausgestattet.

Buffalo Technology gehört mit seinen Buffalo Consumer-NAS zu den globalen Marktführern im Bereich NAS-Systeme. Die Geräte sind schnell und zu Recht für ihre Effektivität und Zuverlässigkeit bekannt.

Dennoch: Ein Ausfall der Buffalo NAS und ein daraus resultierender Datenverlust ist nie auszuschließen. So können beispielsweise Festplattenfehler, Fehler durch die zugreifenden Benutzer, ein Blitzschlag und andere Naturgewalten dazu führen, dass auf die Buffalo NAS kein Zugriff mehr möglich ist, dass Freigaben nicht mehr angezeigt werden oder dass Sie feststellen müssen: Die Buffalo NAS startet nicht mehr.

Wann ist eine Buffalo NAS Wiederherstellung notwendig?

Bei einem Ausfall oder Datenverlust eines Buffalo NAS-Systems ist nur selten die NAS Box selbst die Ursache. Vielmehr entsteht das Problem zumeist durch die im Buffalo-Gerät verbauten Festplatten.

In unserem Datenrettungslabor analysieren wir mit modernsten Methoden, was genau bei Ihrem Buffalo NAS-Server die Ursache des Datenverlusts ist und weshalb der Netzwerkspeicher nicht gefunden wird.

In unserem Datenrettungslabor analysieren wir mit modernsten Methoden, was genau bei Ihrem Buffalo NAS-Server die Ursache des Datenverlusts ist und weshalb der Netzwerkspeicher nicht gefunden wird.

In den meisten Fällen können wir die Daten von Buffalo NAS Systemen erfolgreich wiederherstellen: Durch jahrelange Erfahrung im Bereich NAS Data Recovery und RAID-Datenrettung verfügen wir über profundes Expertenwissen, welches wir durch Recherche und Entwicklung neuer Lösungsansätze für komplexe Konfigurationen zudem unternehmensintern ständig für Sie weiterentwickeln. Die professionelle Datenrettung Ihrer Buffalo Netzwerkfestplatte ist somit bei uns in besten Händen.

Festplattenfehler, Benutzerfehler oder auch Naturkatastrophen können dazu führen, dass auf Daten nicht mehr zugegriffen werden kann, dass Freigaben nicht mehr angezeigt werden oder das Buffalo NAS nicht mehr reagiert bzw. startet.

Hauptächlich führen drei verschiedene Beschädigungen bei Buffalo-Servern zu einem Datenverlust:

Defekte Buffalo Festplatte in Tera Station oder Link Station Server

Eine oder mehrere der Festplatten im Buffalo Gerät sind ausgefallen und der NAS Navigator findet das Gerät nicht mehr. Dies führt dazu, dass die Daten nicht mehr Aufgerufen werden können, das NAS System nicht mehr startet oder die LED Anzeige rot leuchtet. Festplattenfehler müssen professionell diagnostiziert und repariert werden, um die Daten der defekten Festplatte auslesen zu können und so die Benutzerverzeichnisse des Buffalo Netzwerkspeichers retten zu können. Die internen Festplatten des NAS Systems können aus verschiedenen Gründen ausfallen: Head-Crash, defekte Lese-/Schreibköpfe, Motor-Schaden, Überhitzung und Firmware Probleme sind als die häufigsten Ursachen eines Defekts am Buffalo NAS zu nennen.

Default Konfiguration Link Station NAS: RAID-0

Gerade bei Netzwerkfestplatten der Link Station Reihe von Buffalo kann ein Ausfall der internen Seagate Festplatten schnell zu einem Datenverlust führen. Die LinkStation NAS Laufwerke werden ab Werk mit einer RAID 0 Konfiguration ausgeliefert, die keinerlei erhöhten Schutz vor einen Datenverlust bietet. Kommt es zu einem Festplatten-Fehler an einer der beiden Seagate Festplatten im LinkStation-Gerät dann hat der Benutzer kein Zugriff mehr auf die Dateien und Ordner des NAS Servers. Mehr Sicherheit kann bei Buffalo Linkstation-Systemen durch eine Änderung des RAID-Levels auf RAID-1 erzielt werden. Hierbei werden dann die NAS Daten auf beide Buffalo-Festplatten gespiegelt. Fällt eine der Festplatten aus, so ist ein Zugriff auf die Daten noch über die verbleibende Festplatte möglich. Tauscht der Benutzer die defekte Festplatte aus und führt einen Rebuild durch ist die Datenredundanz wieder hergestellt und die höhere Ausfallsicherheit gegeben.

Defekt des Buffalo NAS durch Sturz (heruntergefallen, umgekippt)

Oft werden NAS-Geräte von Buffalo auf den Fußboden oder den Schreibtisch gestellt. Somit kann es vorkommen, dass ein Buffalo Server von Schreibtisch fällt oder versehentlich umgekippt wird. Meist sind die Folgen eines Sturzes für die Buffalo Festplatten fatal, es kommt zu einem Headcrash und zu schweren Oberflächenschäden an den Magnetplatten (Platter) der internen Festplatten. Ein Schwerer mechanischer Festplattendefekt äußert sich meist in einem brummenden oder tickenden Geräusch des Buffalo Speichers. In manchen Fällen kommen aus der Buffalo Tera Station bzw. Link Station aber auch piepende oder schleifende Geräusche. Wenn Ihr NAS heruntergefallen ist, schalten Sie es nicht mehr ein und trennen es sofort vom Strom. Aufgrund des schweren Festplatten-Schadens ist zunächst eine genaue Untersuchung der Beschädigungen in einem Reinraum-Labor nötig, um Folgeschäden zu verhindern.

Gelöschte Dateien / Konfiguration / Freigaben auf Buffalo NAS Server

Durch Stromausfall oder andere unvorhergesehene Ereignisse können Daten beschädigt werden oder die NAS / RAID-Konfigurationen verloren gehen und eine NAS Wiederherstellung notwendig machen. Häufig werden auch versehentlich Daten vom NAS Laufwerk gelöscht, oder Freigaben auf dem NAS Server sind plötzlich verschwunden.

In diesen Fällen des Datenverlusts ist eine genaue Analyse des RAID-Systems notwendig, da der Nutzer über die Konfigurationsoberfläche keine Möglichkeit hat, gelöschte Dateien von einem Buffalo Netzwerkspeicher wiederherzustellen. Auch mit Datenrettungssoftware ist eine Datenwiederherstellung nicht möglich, da diese Recovery Tools i.d.R. für externe Festplatten und Flash-Speicher ausgelegt ist, aber nicht auf Netzwerklaufwerke angewendet werden können.

Obwohl die bei NAS-Servern von Buffalo meist genutzten RAID-Arrays Schutz gegen bestimmte Arten von Hardware-Fehlern einzelner Festplatten bieten, gibt es immer noch viele Gründe, die eine Datenwiederherstellung von einem NAS notwenig machen können.

Obwohl die bei NAS-Servern von Buffalo meist genutzten RAID-Arrays Schutz gegen bestimmte Arten von Hardware-Fehlern einzelner Festplatten bieten, gibt es immer noch viele Gründe, die eine Datenwiederherstellung von einem NAS notwenig machen können.

Am häufigsten sehen wir bei Buffalo Netzwerkspeichern Probleme, wenn mehr als eine Festplatte in einem RAID 5 ausgefallen sind oder mehr als zwei Festplatten in einem RAID 6 nicht mehr funktionieren. Da RAIDs oft aus mehreren ähnlichen Festplatten bestehen, die aus der gleichen Produktionslinie stammen fallen sie auch häufiger zur gleichen Zeit aus.

Dies kann bedeuten, dass mehrere Festplatten gleichzeitig ausfallen oder aber zunächst eine Festplatte einer Buffalo TeraStation bzw. LinkStation ausfällt und nach Austausch der defekten Festplatte beim RAID-Rebuild (Wiederaufbau) eine weitere Festplatte. Dies hat dann den Ausfall des ganzen RAID-Verbund in der Buffalo NAS zur Folge.

Genauso häufig treffen wir Probleme an, die mit einer Beschädigung des XFS Dateisystems zu tun haben, etwa durch defekte Sektoren einzelner Festplatten, durch Abstürze des Buffalo Betriebssystems (LinkStation OS) oder eine fehlgeschlagene Dateisystemprüfung des NAS-Servers. Ein Zugriff auf die Ordner und Dateien ist dann nicht mehr möglich und die Daten scheinen verloren. Unsere Datenrettungstechniker können jedoch das XFS Dateisystem reparieren und so die NAS Daten retten.

Eine weitere mögliche Fehlerquelle, die zum Ausfall eines NAS Laufwerks führen kann, sind Firmware-Probleme bei den NAS Festplatten. Hiervon sind vor allem Festplatten der Seagate Barracuda Baureihe betroffen, aber auch bei Festplatten von Western Digital kann es zu einem Firmware-Defekt bei den Festplatten kommen.

Buffalo RAID Datenrettung bei logischem Schaden

Logischer Datenverlust

Symptome des NAS-Ausfalls

Was tun nach Datenverlust?

Buffalo RAID Datenrettung bei mechanischem Schaden

Mechanischer Schaden am NAS

Symptome des NAS-Ausfalls

Was tun bei Datenverlust?

Professionelle Buffalo NAS Datenwiederherstellung

Professionelle Datenrettung

Umfassendes Know-How und langjährige Erfahrung bei der Datenwiederherstellung Tera Station und Link Station NAS zeichnen unser spezialisiertes Datenrettungsteam aus. Unsere zertifizierten Recovery-Expterten können Daten von allen RAID-Leveln wiederherstellen. Ständige Weiterbildung sowie eigene Forschung und Entwicklung führen zu exzellenten Datenrettungsergebnissen auch bei schweren Schadensbildern.

Modernes Datenrettungslabor

Der Einsatz branchenführende Technologien zur Buffalo NAS Datenrettung bei schweren Schadensbildern wie einem RAID-Crash aufgrund multiplem Festplattenversagens sind für uns selbstverständlich. Wir verfügen über ein ISO-zertifiziertes Reinraum-Labor der Klasse 100 sowie eine umfassende Ausstattung professioneller Recovery Tools. Die eigene Entwicklungsabteilung und spezialisierte Inhouse-Lösungen gewährleisten exzellente Datenrettungsergebnisse und Datenqualität.

24/7 Express-Datenrettung

Maximale Geschindigkeit für die Wiederherstellung Ihrer wichtigen Unternehmensdaten: Unsere Buffalo-Spezialisten stehen Ihnen während des Datenrettungsprozesses (Analyse, Datenrettung, Rollout) 24/7h zur Verfügung. Umgehende und umfassende Beratung, sowie eine schnellstmögliche Datenwiederherstellung Ihrer Tera Station oder Link Station bei höchtster Datenqualität sind unser Markenzeichen.

Wie funktioniert die Wiederherstellung eines Buffalo NAS?

Fundierte Diagnose des Buffalo NAS

Wenn die Buffalo LinkStation oder TeraStation zur Datenwiederherstellung bei uns eingetroffen ist, führen wir als professioneller Datenrettungsdienst zunächst eine genaue Schadensdiagnose durch. Dabei wird zunächst ermittelt, wodurch der Ausfall des NAS Servers verursacht wurde:

Liegt ein mechanischer Schaden an den NAS Festplatten vor, ausgelöst beispielsweise durch einen defekten Lese-/Schreibkopf einer HDD im NAS-System? Sind andere Festplatten-Defekte wie eine schadhafte Firmware feststellbar? Oder handelt es sich um einen logischen Schaden, verursacht zum Beispiel durch Löschen / Überschreiben von Daten oder durch ein fehlgeschlagenes Firmware-Update?

Entwicklung einer Lösung zur Datenrettung

Es gibt nicht die eine Lösung für das Wiederherstellen aller Buffalo NAS Systeme, vielmehr ist jeder Schadensfall individuell zu betrachten. Basierend auf der konkreten Diagnose des schadhaften Buffalo NAS-Modells entwickeln wir daher in jedem individuellen Datenrettungsfall eine für die jeweilige Problemlage adäquate Lösung für die durchzuführende NAS-Datenwiederherstellung:

Mechanische Festplattendefeke wie Headcrash, defekte Schreib-/Leseeinheit(en), Motorschaden, Lagerschaden bei Festplatten und ähnliches werden mit höchster Präzision in unserem hochmodernen Datenlabor bearbeitet.

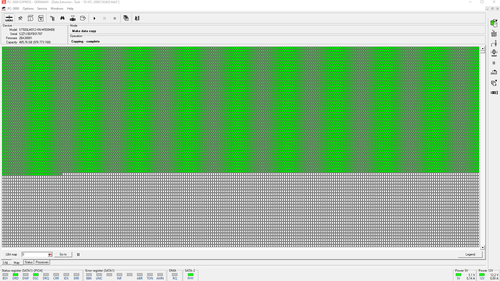

Um die Daten eines defekten Buffalo RAID Arrays rekonstruieren zu können, werden die Festplatten in unserem ISO-zertifizierten Reinraum in einen funktionalen Zustand gebracht. Nachdem die NAS Festplatten repariert worden sind können sie im nächsten Schritt ausgelesen werden. Hierbei werden identische HDD-Abbilder der internen Festpatten des Buffalo NAS, sogenannte Klone, erstellt.

Von diesem Moment an wird ausschließlich mit den Festplatten-Kopien weitergearbeitet, um zu ermöglichen, dass jede weitere Phase des andauernden Wiederherstellungsprozesses zerstörungsfrei verlaufen kann.

Datenkorruption: Reparatur der RAID Metadaten und Dateisystemfehler

Bei dem Ausfall eines Buffalo NAS Servers ist anschließend häufig eine Datenkorruption oder ein beschädigtes Dateisystem auf dem NAS-Gerät feststellbar. Nach der Erstellung der Festplatten-Kopien setzen unsere Experten daher spezialisierte Virtualisierungstechnologien ein, mit denen die Experten das beschädigte RAID-Array reparieren und Schäden am Dateisystem beheben können.

Auf diese Weise wird schließlich der Zugriff auf die verlorenen NAS Daten möglich, nachdem eine Wiederherstellung des virtuelle RAID-Arrays auf Basis der Festplatten-Klone erfolgte.

Dann ist es geschafft: Nach der Reparatur des RAID-Arrays und der Behebung vorliegender Dateisystemschäden werden die NAS Daten wie Benutzerordner und Freigabe-Ordner auf unsere Storage-Server gesichert. In einem letzten Schritt erfolgt dann die Datenübertragung der geretteten Daten auf ein geeignetes Medium.

Nach diesem Prozess sind alle Daten, die vollständig ausgelesen werden konnten, wieder zugänglich und lesbar. In 99% aller Fälle der NAS Datenwiederherstellung bleiben die Ordner- und Dateinamen erhalten.

Während des versicherten Rückversands der wiederhergestellten Daten verbleibt eine Datenkopie noch vorübergehend auf unseren Sicherheitsservern gespeichert, bis uns der Erhalt der geretteten Daten bestätigt wurde.

Als professioneller Datenrettungsdienstleister lagern wir unter keinen Umständen Fälle an Fremdfirmen aus; wir bearbeiten alle Datenrettungsaufträge garantiert vor Ort in unserem eigenen Datenrettungs-Labor. Bei uns ist sichergestellt, dass Ihr Auftrag von einem qualifizierten RAID-Spezialisten bearbeitet wird, der über tatsächliche Erfahrung mit der Buffalo Datenrettung verfügt.

Für unternehmeskritische NAS-Server bieten wir eine beschleunigte Bearbeitung an, um die Ausfallzeiten so gering wie nur irgend möglich zu halten: Unternehmenskunden steht hierfür unser 24/7 Express-Service für die Datenrettung zur Verfügung.

Wir retten Ihre RAID-Daten, egal ob es sich dabei um ein RAID 0, RAID 1, RAID 3, RAID 4, RAID 5, RAID 6 oder RAID 1E, RAID 5E, RAID 5EE, RAID ADG, RAID 0+1 5EE, RAID 50, RAID 51 handelt.

Unterstützte Buffalo NAS Modelle u.a.

Buffalo LinkStation Datenrettung

LS-WX2.0TL

LS-WX4.0TL

LS-WX8.0TL

LS-WXL LinkStation Duo

LS-CH500L

LS-CH1.0TL

LS-CH1.5TL

LS-CH2.0TL

LS-X2.0TL

LS-X3.0TL

LinkStation Live

LS-CH500L

LS-CH1.0TL

LS-CH1.5TL

LS-CH2.0TL

LS-X2.0TL

LS-X3.0TL

LS-WSX500L

LS-WSX1.0TL

LS-WSX2.0TL

LS-VL LinkStation Pro

LS-V2.0TL

LS-V3.0TLL

LS-V4.0TL

LS-WVL LinkStation Pro Duo

LS-WV2.0TL

LS-WV4.0TL

LS-WV6.0TL

LS-QVL LinkStation Pro Quad

LS-QV4.0TL

LS-QV8.0TL

LS-QV12TL

LS-QV16TL

Linkstation 210 series

LS210D0201

LS210D0301

LS210D0401

LS410D0201

LS410D0301

LS410D0401

Linkstation 420 series

LS420D0202

LS420D0402

LS420D0602

LS420D0802

Linkstation 421 series

LS421DE

Linkstation 441 series

LS441D0404

LS441D0804

LS441D1204

LS441D1604

LinkStation 420 DS NVR

LS420D0202S

LS420D0402S

LinkStation 510

LS510D0201

LS510D0301

LS510D0401

LinkStation 520

LS520DE

LS520D0202

LS520D0402

LS520D0602

LS520D0802

Buffalo TeraStation Datenrettung

TS-WX TeraStation Duo

TS-6VHL TeraStation Pro 6

TS-8VHL TeraStation Pro 8

TS-QVH TeraStation Pro

TS-WVH TeraStation Pro Duo

TS-WVHL TeraStation Pro Duo

TS-QVHL TeraStation Pro Quad

TS-RVH TeraStation Pro Rackmount

TS-WXL TeraStation Duo

TS-XEL TeraStation ES

TeraStation 4200D

TeraStation 4400D

TeraStation 4800D

TeraStation 1000

TS1200D0202

TS1200D0402

TS1200D0602

TS1200D0802

TS1400D0404

TS1400D0804

TS1400D1204

TS1400D1604

TS1400R0404

TS1400R0804

TS1400R1204

TS1400R1604

TeraStation 3000

TS3400D0404

TS3400D0804

TS3400D1204

TS3400D1604

TS3400R0404

TS3400R0804

TS3400R1204

TS3400R1604

TeraStation 5000

TS5200D0202

TS5200D0402

TS5200D0602

TS5200D0802

TS5200DN0202

TS5200DN0402

TS5200DN0802

TS5210DF0202

TS5210DF00502

TS5400DN0804

TS5400DN1204

TS5400DN1604

TS5400DN2404

TS5400RN0804

TS5400RN1204

TS5400RN1604

TS5400RN2404

TS5400RH1204

TS5400RH1604

TS5400RH2404

TS5400RH3204

TS5600DN1206

TS5600DN1806

TS5600D0606

TS5600D1206

TS5600D1806

TS5600D2406

TS5800DN2408

TS5800DN3208

TS5800DN4808

TS5800D0808

TS5800D0808

TS5800D1608

TS5800D2408

TS5800D3208

TS5200DWR0202S

TS5200DWR0402S

TS5200DWR0602

TS5200DWR0802S

TeraStation 5400 DWR

TS5400DWR1204

TS5400DWR0804

TS5400DWR0404

TS5400DWR1604

TeraStation 5400 RWR

TS5400RWR0804

TS5400RWR1204

TS5400RWR1604

TS5400RWR2404

TeraStation 5600 DWR

TS5600DWR1206

TS5600DWR2406

TeraStation 7000

TS-2RZH24T12D

TS-2RZH36T12D

TS-2RZH48T12D

TS-2RZH72T12D

TS-2RZH96T12D

TS-2RZS12T04D

TS-2RZH120T12D

TeraStation III Rackmount

TS-RX4.0TL/R5

TS-RX8.0TL/R5

TS-RX12TL/R5

TS-RX16TL/R5

TeraStation iSCSI

TS-IX TeraStation III iSCSI

TS-IXL TeraStation III iSCSI

TS-RIX TeraStation III iSCSI Rackmount

TS-RIXL TeraStation III iSCSI Rackmount

TeraStation Windows Storage Server

WS-6VL TeraStation Pro 6 WSS

WS-WVL TeraStation Pro Duo WSS

WS-QVL TeraStation Pro Quad WSS

WS-RVL TeraStation Pro Rackmount WSS

WS-QL TeraStation WSS Windows Storage Server

TeraStation 5000 WSS

WS5400D0404

WS5400D0804

WS5400D1204

WS5400D0404WR2

WS5400D0804WR2

WS5400D1204WR2

WS5600D1206

WS5600D2406

WS5600D1206SR2

WS5600DR1206S2EU

WS5600D2406SR2

WS5600DR2406S2EU

WS5600DN1206S2

WSH5610DN12S2EU

WSH5610DN24S2EU

WSH5610DN48S6

TeraStation 5810DN

TS5810DN1604-EU

TS5810DN3204-EU

TS5810DN3208-EU

TS5810DN6408-EU

TeraStation 5410DN

TS5410DN0804

TS5410DN1204

TS5410DN1604

TS5410DN2404

TS5410DN3204

TeraStation TS7120r

TS-2RZS08T04D

TS-2RZS12T04D

TeraStation WS5400

WS5400DR0404W2

WS5400DR0804W2

WS5400DR1204W2

TeraStation WS5200

WS5200DR0402W2

WS5200DR0802W2

TeraStation WS5400 Rackmount

WS5400RR0804S2

WS5400RR1604S2

TeraStation 5200 DSP

TS5200D0402SP

TS5200D0802SP

TS5200D1202SP

TeraStation 51210RH

TS51210RH0804

TS51210RH0804-EU

TS51210RH1604

TS51210RH1604-EU

TS51210RH2412

TS51210RH2412-EU

TS51210RH3204

TS51210RH3204-EU

TS51210RH4004

TS51210RH4004-EU

TS51210RH4812

TS51210RH4812-EU

TS51210RH9612

TS51210RH9612-EU

TS51210RH12012

TS51210RH12012-EU

Buffalo weitere Modelle

Buffalo LinkStation 520 6TB

Buffalo LinkStation 520 2TB

Buffalo LinkStation 220 2TB

Buffalo TeraStation TS5810DN 32TB

Buffalo TeraStation TS5810DN 32TB

Buffalo TeraStation 5210DF SSD 512GB

Buffalo LinkStation 220 2TB RAID

Buffalo LinkStation 520 4TB

Buffalo TeraStation WS5420DNW6 16TB

Buffalo LinkStation 520 8TB

Buffalo TeraStation 3410DN 8TB

Buffalo TeraStation 5410DN 16TB

Buffalo LinkStation 520 16TB

Buffalo LinkStation 220 16TB

Buffalo TeraStation WSH5610 48TB

Buffalo TeraStation TS5810DN 16TB

Buffalo LinkStation 520 12TB

Buffalo TeraStation 5410DN 8TB

Buffalo TeraStation WS5220DNW6 8TB

Buffalo TeraStation WS5420DNW6 8TB

Buffalo TeraStation 5210DF SSD 2TB

Buffalo TeraStation TS5810DN 32TB

Buffalo TeraStation WS5420DNW6 32TB

Buffalo TeraStation 51210RH Rackmount 120TB

Buffalo TeraStation 51210RH Rackmount 40TB

Buffalo TeraStation 51210RH Rackmount 16TB

Buffalo TeraStation WS5420RN 16TB

Buffalo TeraStation 5410RN Rackmount 16TB

Buffalo TeraStation 51210RH Rackmount 96TB

Buffalo TeraStation 51210RH Rackmount 48TB

Buffalo TeraStation WS5420RN 32TB

Buffalo TeraStation 51210RH Rackmount 144TB

Buffalo TeraStation 51210RH Rackmount 48TB

Buffalo TeraStation 51210RH Rackmount 8TB

Buffalo TeraStation 51210RH Rackmount 24TB

Was ist ein RAID-Array und welche Typen werden unterstützt?

Die Abkürzung RAID steht für „Redundant Array of Independent Disks“. Es handelt sich bei einem RAID also um eine redundante Anordnung von unabhängigen Festplatten, meist als logischer Festplattenverbund.

Durch die Organisation mehrerer physischer Festplatten in einem ein RAID-Array zu einem logischen Laufwerk wird eine verbesserte Datenverfügbarkeit beim Ausfall von einzelnen Festplatten erzielt. Die Vorteile von RAID-Arrays nutzen auch die NAS-Netzwerkspeicher und bieten hohe Speicherkapazitäten und schnellen Datenzugriff bei gleichzeitiger erhöhter Ausfallsicherheit.

Daten werden bei einem RAID-Array redundant auf den beteiligten physischen Festplatten verteilt, was je nach Konfiguration und RAID-Level auch zu einer erhöhten Zugriffsgeschwindigkeit führt und RAID-Systeme damit für einen gemeinsamen Zugriff etwa in Arbeitsgruppen-Netzwerken interessant macht.

Unterschiedliche RAID-Konfigurationen bei NAS Systemen

Dabei können je nach RAID-Konfiguration auch mehrere Festplatten ausfallen, ohne dass es zu einem kompletten Datenverlust kommt. Nach einem Austausch der ausgefallenen Festplatte und einem anschließenden Rebuild des RAID-Arrays im NAS kann der ursprüngliche Zustand wieder hergestellt werden, ohne dass die Intigrität und Funktionalität des logischen Laufwerkes Schaden nimmt.

Dennoch kann es aufgrund von Laufwerksdefekten oder logischen Schäden in einem NAS notwendig werden, eine Datenwiederherstellung des RAID durchführen zu müssen.

Wir bieten die Datenrettung von NAS-Systemen von allen Marken von NAS-Systemen und Speichergeräten an, von kleinen Heimanwender- und Heimbürosystemen bis hin zu High-End multibay NAS-Servern, die für Unternehmen für alle Arten von Speicheranwendungen verwendet werden wie etwa als Fileserver, Mailserver, iSCSI, VM Lun-Speicher, Datenbank-Server und Backup-Systeme.

Als professioneller Dienstleister zur Datenrettung von NAS-Systemen können wir mit unseren spezialsierten Technologien zur Datenwiederherstellung alle Level von RAID-Arrays aus NAS-Systems wie RAID 0, RAID 1, RAID 4, RAID 5, RAID 6 und die Hybrid-Level wie Raid 10, RAID 50, RAID 51 wiederherstellen und die Daten von solchen Systemen retten.

Wir retten auch die Daten von NAS-Speichern, die proprietäre RAID-Arrays einsetzten, wie etwa Drobo, Netgear XRaid, Synology SHR, ZFS, etc.

Fragen und Antworten zur Buffalo NAS Rettung

FAQ Datenrettung Buffalo NAS

Prinzipiell können die Festplatten aus dem defekten Buffalo NAS in ein funktionierendes Buffalo-Gehäuse umgebaut werden. Jedoch ist dies mit einem nennenswerten Risiko für die Daten verbunden! Eine Festplatten-Migration kann nur klappen, wenn es sich um ein absolut identisches Gerät mit identischer Firmware-Version handelt und die Reihenfolge der Festplatten zudem nicht verändert wird. Bei wichtigen Daten raten wir generell von derlei Experimenten ab. Zu schnell können hierbei Fehler passieren, zum Beispiel durch das versehentliche Überschreiben von Daten – und überschriebene Daten können dann auch professionell nicht wieder hergestellt werden.

Ihr Buffalo NAS-Server piept dauerhaft: Dann liegt wahrscheinlich ein Hardware-Schaden vor. Bei Ihrem Buffalo-NAS könnte der Gehäuselüfter ausgefallen sein oder aber eine oder mehrere verbaute Festplatten im Buffalo NAS sind defekt. Wir empfehlen: Fahren Sie Ihre piepende Buffalo NAS Station sofort herunter oder schalten Sie das NAS-Gerät hart aus. Wir ermitteln schnell und zuverlässig die Ursache, warum Ihr Buffalo NAS piept. Kontaktieren Sie unsere Recovery-Experten für eine fundierte Einschätzung des Schadens und für eine professionelle Datenrettung von Buffalo NAS Speichern.

Eine oder mehrere LED Lampen an der Buffalo NAS blinken rot? Dann liegt meist ein Festplattendefekt bei den entsprechenden NAS Festplatte vor! Fahren Sie die Buffalo LinkStation oder Buffalo TeraStation herunter oder schalten das NAS aus und kontaktieren Sie uns für eine fundierte Schadensdiagnose Ihres Servers. In den meisten Fällen können wir die Buffalo Daten retten.

Ihr Buffalo NAS wird im Netzwerk nicht mehr gefunden? Egal ob Buffalo TeraStation Defekt, LinkStation Netzwerkfehler oder Buffalo CloudStation Ausfall: Wenn für Buffalo NAS kein Netzwerkzugriff mehr besteht bzw. Ihr Buffalo NAS im Netzwerk nicht mehr angezeigt wird, liegt meist ein Festplatten-Schaden vor. Durch den Festplatten-Defekt kann das Betriebssystem ( LinkStation OS) des NAS gar nicht mehr starten oder bestimmte Dienste des Buffalo starten nicht. Als Folge wird das NAS im Netzwerk nicht mehr angezeigt und ein Zugriff auf die Buffalo-Laufwerke ist nicht mehr möglich. Mit professionellen Mitteln kann aber in den meisten Fällen eine Datenwiederherstellung erfolgreich durchgeführt werden. Wir helfen Ihnen, nehmen Sie Kontakt auf!

Ja, in den meisten Fällen ist eine Buffalo NAS Datenwiederherstellung nach fehlgeschlagenem Firmware-Upgrade (DSM) möglich. Meist wird allerdings ein solcher NAS Fehler durch Beschädigungen an den Festplatten verursacht, weshalb das DSM-Update der Buffalo NAS nicht gelingen kann. Es ist in jedem Fall eine fundierte Diagnose erforderlich, warum Ihr Buffalo NAS ausgefallen ist. In unserem Datenrettungslabor führen wir die Analyse für jedes defekte Buffalo NAS System individuell durch. So lassen sich Fehlerbilder sehr klar abgrenzen und die Chancen einer Buffalo Datenrettung nach fehlgeschlagenem Firmware-Update für den konkreten Fallspezifisch ermitteln.

Häufige Fehlermeldungen bei Buffalo NAS

Buffalo NAS blinkt & piept

Firmware-Update fehlgeschlagen, Stromausfall im laufenden Betrieb, Festplatte defekt

Fehler E23 bei Buffalo NAS

Festplatte in NAS ist defekt oder Festplatte beschädigt

Blinken der Error LED an LinkStation oder TeraStation

Eine oder mehere Festplatten werden nicht erkannt

Buffalo Fehler E07

Ein oder mehrere Festplatten werden nicht gefunden

Buffalo Fehler E15

Schreib/Lesefehler bzw. E/A Fehler bei Festplatten, mechanischer Festplatten-Defekt

Fehler E16 bei LinkStation oder Terastation

Festplatte ist nicht angeschlossen oder Festplatte funktioniert nicht richtig

Am häufigsten bearbeiten wir die Datenrettung von RAID 0, RAID 1, RAID 5, RAID 10 und RAID 6 Konfigurationen. Weitere unterstützte Konfigurationen umfassen u.a.:

- RAID 1E

- RAID 5E

- JBOD

- X-RAID

- Synology SHR

- RAID-Z

- RAID Matrix-RAID

- sowie weniger bekannte RAID Typen

Am häufigsten führen wir RAID Reparaturen und RAID Datenrettung von Herstellern wie Synology, QNAP, Iomega und Buffalo durch, aber auch von:

3com, 3Ware, Adaptec, Adic, Allnet, Asus, Axis, Buffalo, Compaq, Conceptronic, D-Link, DELL, DTK, EMC, Fantec, Freecom, Fujitsu-Siemens, HP, IBM, Inostor, Intel, Intransa, Iomega, Lacie, Levelone, Linksys, Longshine, Mapower, Maxtor, Microtest, Multicase, Netapp, Netgear, Network Appliance, Overland, Pioneer, Plasmon, Plextor, Promise, Quantum, Raidsonic, Sitecom, SMC, Sonicwall, Sony, Sun, Synology, Tanberg, Teac, Techsolo, Thecus, Trekstor, Western Digital, Zyxel

Linux und Unix Derivate (Dateisysteme: Raiser FS, EXT2, EXT3, EXT4, HTFS, EAFS, VxFS, UFS, UFS1, UFS2 und FFS)

DOS/Windows – NT4, W2K, XP, Vista, Server (Dateisysteme: FAT12, FAT16, FAT32, VFAT, NTFS, NTFS5)

Apple / Macintosh / MAC OS X und OS/2 (Dateisysteme: HFS, HFS+ und HPFS)

SUN Solaris Intel und Spark (Formate: UFS)

Novell (Formate: NWFS und NSS)

Virtualisierung VmWare (VMFS)

KVM und weitere.